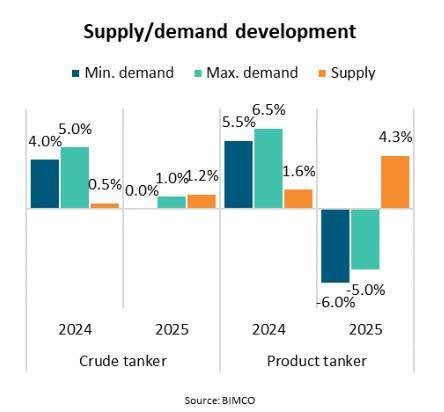

Niels Rasmussen, BIMCO’s Chief Shipping Analyst, anticipates a stronger year for crude and product tankers in 2024 compared to 2023, despite weaker cargo volumes in the first half of the year. The BIMCO Tanker Shipping Market Overview & Outlook for August 2024 highlights muted fleet and supply growth in both markets as a key factor contributing to the predicted strengthening of the supply/demand balance. Longer sailing distances, resulting from ships rerouting via the Cape of Good Hope, are expected to support strong tonne miles and demand growth in 2024, even with limited cargo volume growth. The assumption that attacks on ships in the Red Sea may cease by 2025 could allow ships to use normal routings throughout the year, impacting tonne miles and ship demand.

During the first half of 2024, both the crude and product tanker markets experienced year-on-year growth in asset prices and time charter rates. While product tankers saw a significant increase in freight rates, weakness in Aframax and Suezmax vessels limited the Baltic Exchange index for crude tankers. Second-hand prices rose more than newbuilding prices, with the ratio between the price for a five-year-old ship and a newbuild reaching 88% and 96% for product and crude tankers, respectively. BIMCO foresees a strengthening of freight rates in the second half of 2024 compared to current levels, with expectations for limited further price increases unless there is a significant uptick in dry bulk contracting activity.

In the macro environment, the International Monetary Fund predicts global economic growth of 3.2% in 2024 and 3.3% in 2025, following a 3.3% growth in 2023. Regions such as Europe & Mediterranean, South & Central America, and Sub-Saharan Africa are forecast to grow faster during 2024-2025 compared to 2023, while other regions are expected to see slower growth rates. Despite the projected slower growth, East & Southeast Asia and South & West Asia are forecast to drive a significant portion of global growth during the two years, with North America, Oceania, and other regions expected to grow at lower rates than in 2023.