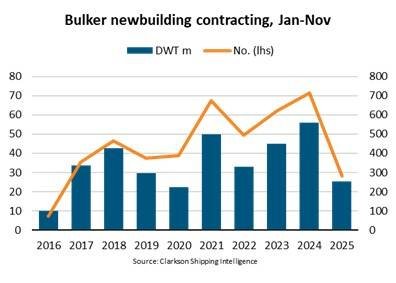

Between January and November 2025, newbuilding contracts for bulk carriers have plummeted by 54% year-on-year, totaling 25 million DWT—the lowest since 2020. This decline has shrunk the dry bulk orderbook by 4% from the previous year, now representing 11% of the fleet. Filipe Gouveia, Shipping Analysis Manager at BIMCO, attributes this drop to an uncertain market outlook, with the number of contracted vessels down 61% year-on-year, marking only 281 orders—the fewest since 2016.

While all segments have experienced a downturn in orders, the capesize segment remains relatively stronger. The outlook for freight rates appears most favorable for capesize vessels, despite potential softening in cargo demand. Increased sailing distances are expected to elevate tonne-mile demand, and limited supply growth may further support rates. However, 77% of capesize contracts scheduled for delivery are set for after 2027, indicating long lead times.

In contrast, the supramax and panamax segments have seen significant declines in contracting—76% and 55% year-on-year, respectively. Both segments have substantial orderbooks, leading to anticipated increases in deliveries in 2026 and 2027. Weak demand and the potential return of ships to the Red Sea pose additional risks, likely impacting freight rates negatively.

Chinese shipyards dominate the market, securing 81% of new orders by capacity, a 9% increase from 2024, while Japan’s share diminishes. Despite earlier USTR port fees on Chinese-built ships, the preference for Chinese yards persists, driven by limited U.S. cargoes and fee exemptions. Additionally, a 3% reduction in newbuilding prices, contrasted with rising second-hand values, may encourage contracting. However, long lead times suggest that current orders could face vastly different market conditions upon delivery. Currently, 12% of the orderbook is designed for alternative fuels, with a notable increase in retrofitting capabilities, reflecting ongoing uncertainty about alternative fuel availability.

Share it now