The Fuel EU Maritime Regulation, effective from January 1, 2025, requires vessels over 5,000 gross tonnage to reduce their greenhouse gas emissions progressively. Shipowners must submit a monitoring plan by August 31, 2024, to comply with the detailed reporting system.

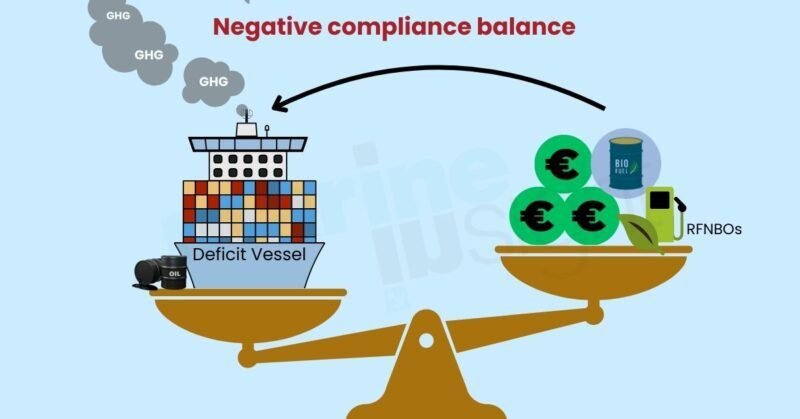

Shipowners failing to meet the GHG intensity target can opt for penalties or use flexibility mechanisms like pooling, banking, or borrowing. Penalties for non-compliance can be steep, escalating up to €2,400 per tonne of energy equivalent to VLSFO usage.

Pooling allows vessels to collectively manage GHG compliance, balancing deficits and surpluses across the fleet. This collaborative approach promotes the adoption of renewable fuels and helps mitigate financial risks for shipowners.

Vessels with surplus compliance balances can sell them to those with deficits, creating a trading mechanism that monetizes investments in low-carbon fuels. Early adopters of green technologies can gain a competitive advantage and enhance their reputation among stakeholders by operating compliant vessels.

Share it now