Charter rates for dry bulk carriers, Capes, and Panamax sectors have continued to rise, leading to a shortage of tonnage at bidding tables. Despite this, local port positions have seen healthy arrivals and deliveries following a recent fire sale in Bangladeshi and Indian waterfronts. The first quarter of 2025 has been turbulent, with vessel prices dropping by over USD 150/LDT since January 2024, due to economic and trade pressures affecting ship recycling sentiments and aggression.

Ship recyclers are facing challenges in being aggressive, impacting global residual values of recycling candidates. Geopolitical pressures have slowed ship recycling sales, with yards focusing on recent deliveries and tier-2 recyclers waiting for low-priced deals. In Bangladesh, protests and political clashes have increased, while Indian recyclers are adjusting their prices towards Pakistani levels, making the market more active. Turkey has reported no significant changes in ship recycling activity.

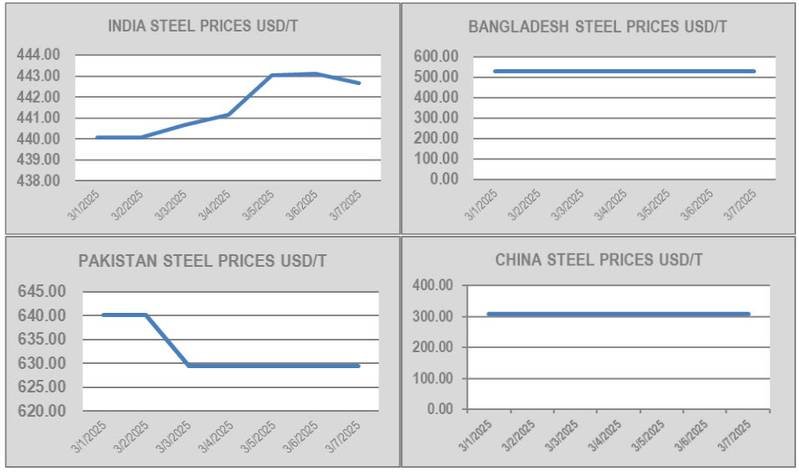

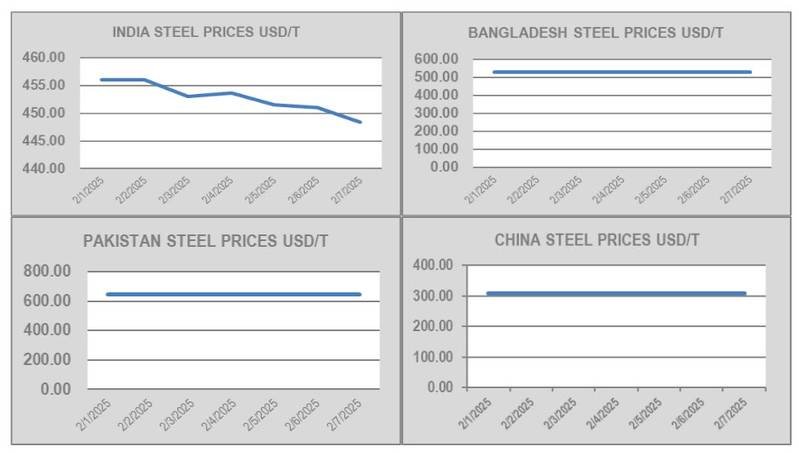

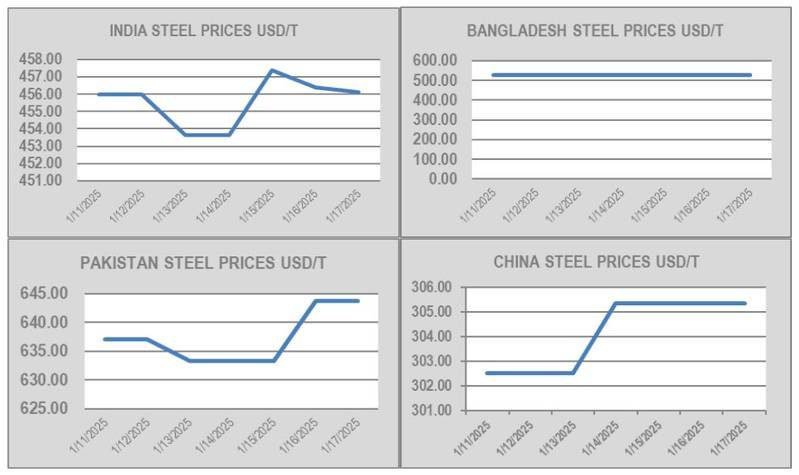

Ship recycling yards are busy upgrading their facilities in preparation for the Hong Kong Convention’s entry into force on June 26. Despite challenges in the industry, ship recycling rankings and pricing for week 10 of 2025 show ongoing activity in the market.