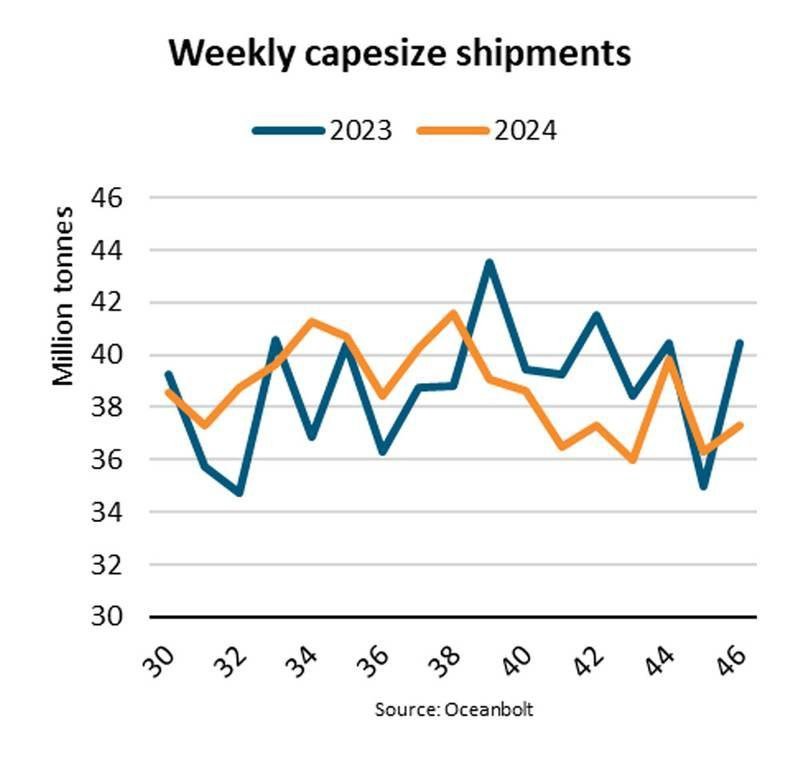

The dry cargo shipping sector is currently experiencing a positive upturn, with the Baltic Dry Index (BDI) indicating improvements and major financial institutions like Deutsche Bank showing interest. The BDI, a key market indicator, has fluctuated between 1,500 and 2,000 points over the past ten months, with a notable spike in late 2023 when it exceeded 3,500 points. The Capesize segment has been particularly strong, with significant price increases suggesting a potential industry turnaround.

Deutsche Bank recently initiated coverage on Star Bulk (SBLK) and Genco (GNK), two prominent companies in the dry cargo sector. This move reflects a growing investor interest in dry cargo shipping stocks following a booming tanker market since early 2022. Star Bulk, known for strategic acquisitions like Eagle Bulk, has been commended for its prudent financial approach, including a focus on deleveraging and dividends for shareholders.

Both Star Bulk and Genco have implemented financial strategies aimed at balancing shareholder rewards with fleet management requirements. Deutsche Bank specifically highlighted Star Bulk’s dividend policy as a model of prudent cash and balance sheet management. As the dry bulk sector shows signs of recovery, industry watchers will be monitoring closely to see if this trend continues and how it may impact the broader shipping market.