In March 2020, the cruise industry was hit hard by the COVID-19 pandemic, with passengers stranded on ships around the world. Fast forward to today, and the global cruise ship industry, led by Carnival Corp, is experiencing a resurgence. Carnival Corp has forecasted strong bookings for 2025, with a surge in demand for cruise vacations. Despite rising input costs and advertising spending, the company posted better-than-expected profit and sales for the fourth quarter. Adjusted cruise costs, excluding fuel, increased by 7.4% from 2023, but were better than projected.

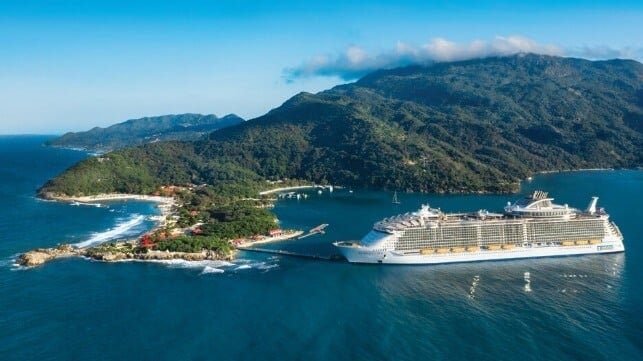

CEO Josh Weinstein stated that 2025 is expected to be a strong year for the company, with yield growth outpacing historical rates. Carnival Corp reported quarterly revenue of $5.94 billion, slightly exceeding analyst estimates. However, the company projected annual profit to be slightly below expectations at $1.70 per share. Carnival, along with Royal Caribbean and Norwegian Cruise Line Holdings, has been investing in private island destinations to attract younger travelers and increase returns.

The company’s profit forecast was impacted by operating costs associated with these investments, maintenance costs due to increased dry dock days, and expenses from the wave season. Despite these challenges, Carnival Corp remains optimistic about the future of the cruise industry and its ability to continue attracting passengers with unique experiences and destinations.