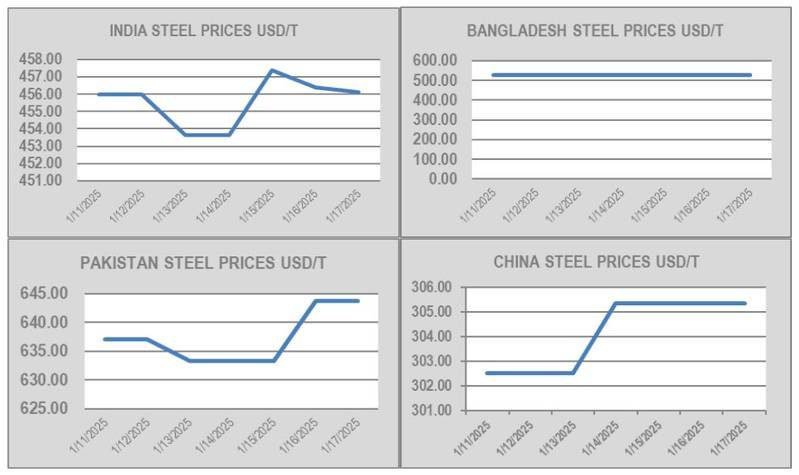

Recycling nation currencies experienced declines this week, with the Bangladeshi Taka seeing the largest depreciation, according to cash buyer GMS. The Baltic Shipping Index also noted a downward trend in various sectors, leading to a nearly 6% decline in dry bulk markets. Despite predictions of a healthier first quarter for ship recycling markets, recent reversals in vessel prices have been attributed to weaker currencies, depressed sentiments, and declining steel plate prices.

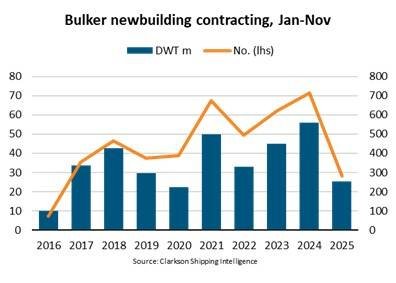

The year 2024 marked the lowest volumes for recycling in over a decade, as the exit of over-aged vessels from fleets was delayed due to strong performance in freight markets. The sudden increase in supply of 90s-built dry bulk vessels, mainly from Chinese ship owners looking to sell before the Chinese New Year holiday, has put pressure on sub-continent markets. Bangladesh, in particular, has seen vessel prices drop significantly, leading to a surplus of cheaper tonnage for recyclers.

The supply of vessels for recycling has mainly consisted of vintage bulkers and a few LNGs, with tankers and container ships expected to enter the market at varying stages throughout the year. The uncertainty surrounding the disposal of elderly tankers on recent sanction lists adds to the unpredictable outlook for ship recycling. Ship owners seeking higher prices and eager cash buyers driving prices up further contribute to the volatile nature of the market. GMS’s demo rankings and pricing for the third week of 2025 are available for reference.