Spot freight rates on major container routes have seen a continued decline due to stagnant demand. Despite expectations of a possible short-term recovery before Golden Week, no improvement has materialized. Golden Week, starting on October 1st, halts work across the country, typically leading to a surge in demand in the two weeks leading up to it. However, shippers are currently facing more urgent concerns, such as the looming threat of a strike on the US East Coast and Gulf. This has resulted in a significant drop in spot rates between East Coast Asia and North America.

To avoid disruption from the planned ILA strike in October, shipping lines are redirecting cargo from the US East Coast to the West Coast, causing a decrease in demand and a drastic 21% drop in East Coast spot prices. Drewry anticipates further decreases in East-West prices in the upcoming weeks as the impact of weak demand continues to be felt. Judah Levine, chief analyst at Freightos, noted that as the deadline for container shipping from Asia to the East Coast approaches, carriers are reducing prices, with expectations of significant rate drops soon.

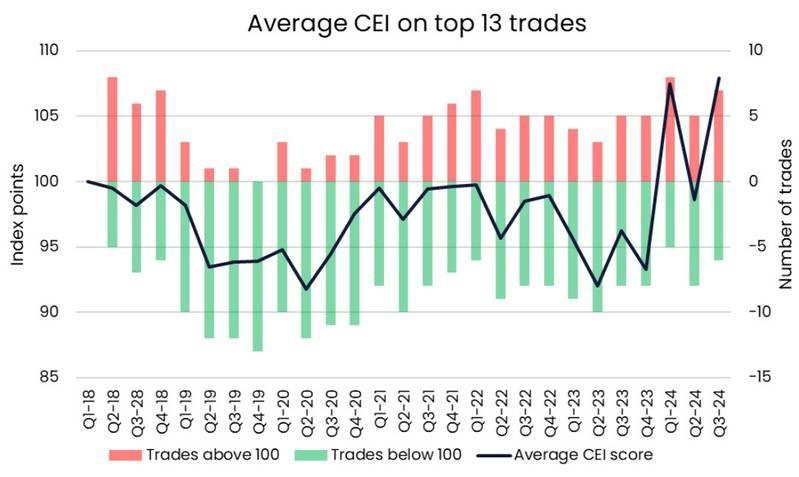

Despite ongoing declines in spot rates on major trade lanes like Asia-Northern Europe and Asia-Mediterranean, year-on-year comparisons show a significant increase. While current spot rates on certain routes are lower than previous peaks, they remain significantly higher compared to a year ago. These market fluctuations indicate the premature end of the 2024 peak season. The industry is closely monitoring developments as potential disruptions, such as the looming strike and shifting demand patterns, continue to impact container shipping.