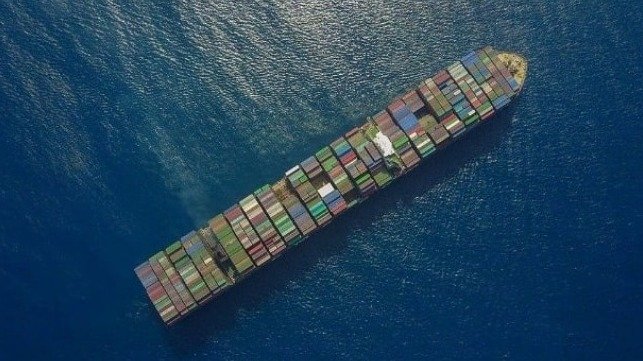

Maersk, a Danish shipping giant, has warned that overcapacity in container shipping will impact profits more than expected this year. Despite disruptions in the Red Sea increasing freight rates, Maersk has not seen a significant boost in profits, leading to a decline in share prices. This stands in contrast to recent investor optimism about the sector, as container shippers have been among the best-performing stocks in Europe this year.

Maersk, along with other shippers, has been rerouting ships around Africa due to disruptions in the Red Sea caused by attacks in 2019. However, the company’s CEO, Vincent Clerc, stated that there are twice as many new ships entering the market compared to the additional capacity needed to transport ships across Africa. This overcapacity is expected to be felt in 2024 and possibly into 2025 and 2026.

Maersk, considered a barometer of global trade, expects underlying earnings before interest, taxes, depreciation, and amortization (EBITDA) of between $1 billion and $6 billion this year, compared with $9.6 billion last year. The company has also suspended its share buyback program due to the warnings. Despite potentially boosting first-quarter profits, the general state of overcapacity is likely to return in 2024 and possibly continue into 2025 according to analysts at JP Morgan. Additionally, Maersk has stated that the Red Sea crisis does not match the scale of disruption caused by the pandemic.