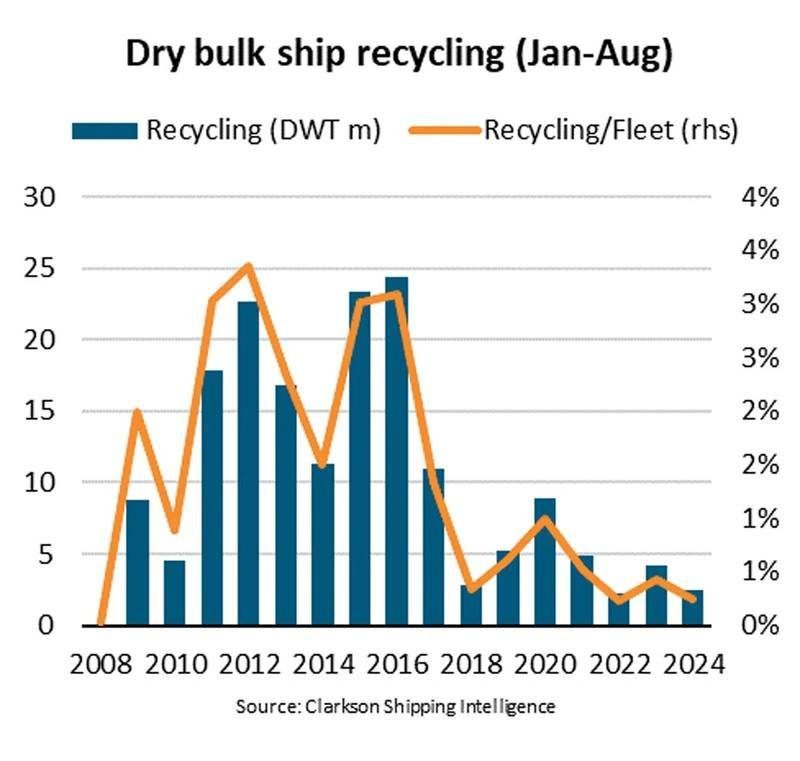

The number of recycled ships has decreased by 42% year-on-year between January and August 2024, reaching the second lowest level in 16 years. This decline can be attributed to high freight rates and strong demand in the market, which have delayed the recycling of older ships. Despite slow growth in the fleet on the supply side, fleet renewal has been limited due to these market conditions, according to Filipe Gouveia, Shipping Analyst at BIMCO. Only 45 ships totaling 2.5 million deadweight tonnes have been recycled so far this year, accounting for just 0.2% of the fleet. Recycling has dropped across all segments, with capesize and supramax experiencing the most significant decline compared to last year.

Demand shocks in the past three years have contributed to stronger-than-anticipated demand in the shipping industry. Factors such as sanctions on Russian coal and rerouting away from the Red Sea and Panama Canal have increased sailing distances, keeping ships at sea for longer periods. On the supply side, the dry bulk sector has seen low deliveries, a small orderbook, and limited newbuild contracting, partly due to high newbuilding prices and uncertainty regarding new fuels. Despite increased competition for shipyard slots since 2021, fleet renewal is not expected to be a significant challenge in the short term, as only 9% of capacity is 20 years old or above.

Bulk carriers are typically designed to operate for around 25 years, with only 3% of capacity currently aged 25 years or above. Older ships are more common in the handysize segment, accounting for 8% of the segment’s capacity, while capesize ships are usually recycled before reaching 25 years of age. In the future, more ships are expected to be replaced to comply with upcoming climate regulations, as energy and fuel efficiency will be crucial for decarbonization. While ship design has not significantly changed in the past two decades, younger ships are slightly more efficient and better suited for investment in fuel-saving technology due to their longer lifespan. Gouveia projects that ship recycling will gradually rebound as market conditions normalize and stricter climate policies come into effect, leading to the phased-out of older, less competitive vessels in the medium term.