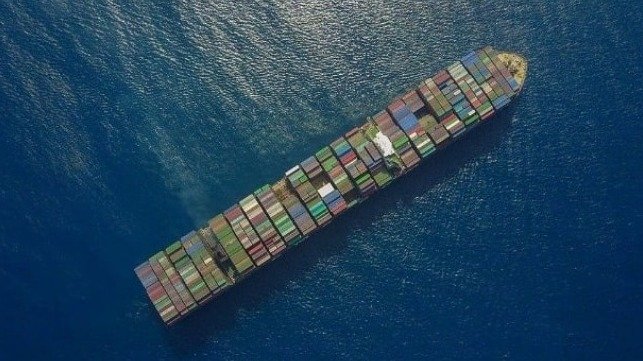

Maersk, a global container carrier based in Copenhagen, raised its profit forecast due to disruptions in the Red Sea impacting global supply chains. This is the second time in a month that Maersk has adjusted its forecast after attacks by Houthi militias forced ships to divert their routes. The disruptions have significantly reduced container traffic through the Suez Canal, leading to a decrease in capacity across Maersk’s global fleet and an increase in freight rates.

The company also noted further port congestion in Asia and the Middle East, causing prices to rise and demand in the container market to remain strong. Maersk expects this trend to lead to stronger financial performance in the second half of the year, resulting in an adjusted earnings forecast of $7 billion to $9 billion for 2024. Analysts had predicted $5.86 billion, according to Bloomberg estimates.

Despite the profit increase and rise in share prices, analysts caution that the structural oversupply in container shipping still persists, and the disruptions in the Red Sea only offer temporary relief. Bloomberg Intelligence analysts highlight the impact of port congestion and disruptions on freight rates, emphasizing that high prices will continue as ships are unable to transit the Suez Canal safely. The overall liner market is expected to see higher earnings due to these factors.